Begin your journey as a US Certified Public Accountant

Start your transformation into a CPA and open doors to a world of possibilities in the accounting field. Leap towards a brighter future!

Earn your CPA certification with the institute that pioneered the CPA program in India.

As the longest-standing partner of UWorld in India, Orbit Institutes offers a proven learning experience that prepares you to excel on exam day and advance your career with confidence.

Years Of Excellence

CPA Candidates Trained

Strategic Partner Of Uworld

Experienced Instructors

About the US CPA

The Certified Public Accountant (CPA) designation, awarded by the American Institute of Certified Public Accountants (AICPA), is recognized as the highest professional credential in accounting and finance. CPAs are trusted advisors to individuals, businesses, and organisations worldwide, known for their expertise in auditing, taxation, financial planning, reporting, and strategic analysis.

To become a CPA, candidates must complete the academic requirements, typically including 120 credit hours. CPAs play critical roles in public accounting firms, multinational corporations, government agencies, and consulting practices, ensuring financial accuracy, regulatory compliance, and ethical standards. Their skills are highly valued across industries such as banking, investment, technology, and manufacturing, making the CPA a powerful qualification for global career growth.

In India, the US CPA credential is increasingly sought after, as it provides international recognition and opens doors to senior roles in auditing, advisory, and finance leadership positions, both domestically and abroad.

US CPA = Indian CA

Highest qualification by AICPA

4 Part Exam

12- 18 Months

Global work opportunities

Jobs In Big 4 And MNCs

Why become a US CPA?

Enhanced Career Options

Get access to diverse career opportunities across industries, opening doors to global roles and specialized positions.

Industry Demand

Stay relevant in today’s job market by developing skills that are in constant demand.

Higher Earning Potential

Increase your chances of securing higher salaries with advanced expertise and proven credentials.

Advanced Analytical Skills

Master critical thinking, problem-solving, and data-driven decision-making for career growth.

Credibility and Prestige

Gain recognition and respect in your field with qualifications that enhance your professional reputation.

Business Leadership Potential

Prepare yourself for senior management and leadership roles with the confidence to lead teams and organizations.

Career Opportunities after CPA

CPAs' roles and career paths are diverse and essential in various industries, making them invaluable assets across all business sectors.

- Consulting Services

- Corporate Accountant

- Auditing & Assurance Services

- Financial Analysis & Planning

- CFO or Financial Manager

- International Accounting

- Information Technology Services

- Forensic Accounting

- Litigation Services

- Risk Manager

- Management Accountant

- Non-Profit Organizations

- Taxation Services

- Public Accounting

- Business Valuation

Why choose our US CPA course in India?

Orbit Institutes has guided CPA aspirants since 1997, assisting many students and serving numerous Indian and global corporations. Choose us for a trustworthy and robust CPA journey.

Learn from a pool of talented faculty with 27 years of teaching experience. Our instructors, who are CPAs and CMAs and hold advanced degrees in accounting or finance, are committed to your success and provide high-quality education.

Partnering with UWorld, we offer over 220 hours of coaching instructions, detailed methodology, and the No. 1 rated review course materials. Our program includes MCQs, a comprehensive question bank, mock tests, and a study planner to ensure thorough exam preparation.

We offer flexible fees and online and weekend classes to fit your schedule. Our live interactive online classes and 24/7 supportive team make it easy to balance your professional and personal commitments while preparing for the CPA exam.

Orbit Institutes go beyond training by offering 100% job placement assistance. With 28,000 students well-placed in India and abroad, including the US, UK, and Australia, we help you kickstart your career and connect you with relevant job opportunities.

Join a supportive community where our alumni work at top MNCs. Our dedicated team provides personalized mentorship, helping you navigate the CPA journey with confidence and success.

What Orbit Institutes brings to you

Live Online Interactive Classes

Physical Study Material

Recorded Sessions

Mock Exams

Continuous Mentor Support

Doubt Solving Sessions

100% Job Placement Assistance

Experienced Instructors

3 E’s for CPA certification

To start your CPA journey, you must meet three key criteria: Education, Eligibility, and Exam requirements.

Education

- 120 credit hours of specific coursework

- Pass the ethics exam

- 2 years of work experience

- 2,000 hours work experience (tax, audit, accounting, consulting)

Find Out If You Meet

These Requirements!

Eligibility

- 120 credits are needed to take the exam, and 150 credits are required for full license.

- Typically requires a bachelor’s in commerce, accounting, or finance.

- Candidates eligible to sit for the CPA Exam include Chartered Accountants, ICWAs, Company Secretaries, MBAs, Post-Graduates with an accounting background, and Commerce Graduates.

Find Out If You Meet

These Requirements!

Exam

- Pass score: 75 on a scale of 0-99 (not a percentage).

- Multi-stage testing for MCQs: Difficulty adjusts based on your performance. Harder questions are worth more points.

- Task-Based Simulations (TBS): Solve problems based on scenarios.

Find Out If You Meet

These Requirements!

US CPA Exam Structure

CPA Exam Overview

- 4 Parts Computer-based exam.

- On-demand exams are available at prometric centers in India and globally.

- It is held in U.S. territories and international locations, making it accessible worldwide.

- Includes objective-based questions such as MCQs and task-based simulations.

- 100% computer-graded.

- Passing score of at least 75%.

- Candidates must complete all four papers within 30 months in most states.

- Flexible exam scheduling.

The US CPA Exam structure comprises four key sections

In 2024, the CPA Evolution introduced an updated exam structure. The new structure includes three mandatory core exams and three discipline exams, out of which one has to be chosen, ensuring that CPAs possess a well-rounded skill set and expertise.

78 MCQs (50% Weightage)

7 Short TBS (50% Weightage)

- Ethics, Professional Responsibilities & General Principles (15-25%)

- Assessing Risk & Developing a Planned Response (25-35%)

- Performing Procedures & Obtaining Evidence (30-40%)

- Forming Conclusions & Reporting (10-20%)

50 MCQs (50% Weightage)

7 TBS (50% Weightage)

- Financial Reporting (30-40%)

- Select Balance Sheet Accounts (30-40%)

- Select Transactions (25-35%)

72 MCQs (50% Weightage)

8 TBS (50% Weightage)

- Ethics, Professional Responsibilities & Federal Tax Procedures (10-20%)

- Business Law (15-25%)

- Federal Taxation of Property Transactions (5-15%)

- Federal Taxation of Individuals (22-32%)

- Federal Taxation of Entities (23-33%)

50 MCQs (50% Weightage)

7 Short TBS (50% Weightage)

- Business Analysis (40-50%)

- Technical Accounting & Reporting (35-45%)

- State & Local Governments (10-20%)

82 MCQs (60% Weightage)

6 Short TBS (40% Weightage)

- Information Systems & Data Management (35-45%)

- Security, Confidentiality & Privacy (35-45%)

- Considerations for System & Organization Controls (SOC) Engagements (15-25%)

68 MCQs (50% Weightage)

7 Short TBS (50% Weightage)

- Tax Compliance & Planning for Individuals & Personal Financial Planning (30-40%)

- Entity Tax Compliance (30-40%)

- Entity Tax Planning (10-20%)

- Property Transactions (Disposition of Assets) (10-20%)

US CPA Exam Prometric centers in India

Ahmedabad

Bangalore

Chennai

Delhi

Hyderabad

Kolkata

Mumbai

Trivandrum

Delhi

US CPA Exam Pattern and Format

| Features | Details |

|---|---|

| Structure | 3 Core Sections + 1 Elective Section (Choose one out of 3) |

| Core Sections |

1. Auditing and Attestation (AUD) 2. Financial Accounting and Reporting (FAR) 3. Taxation and Regulation (REG) |

| Elective Sections |

1. Business Analysis and Reporting (BAR) 2. Information Systems and Control (ISC) 3. Tax Compliance and Planning (TCP) |

| Duration | 4 hours per section |

| Testlets per section | 5 – 7 |

| Testlet format |

1. Multiple Choice Questions (MCQs) 2. Task-Based Simulations (TBS) |

| MCQs |

1. Number of questions: ~72–76 per section 2. Weightage: 50% of the total score |

| Task-Based Simulations (TBS) |

1. Number of simulations: 7-8 per section 2. Weightage: 50% of the total score 3. Covers applying accounting knowledge to real-world scenarios |

| Passing Score | 75 in each section |

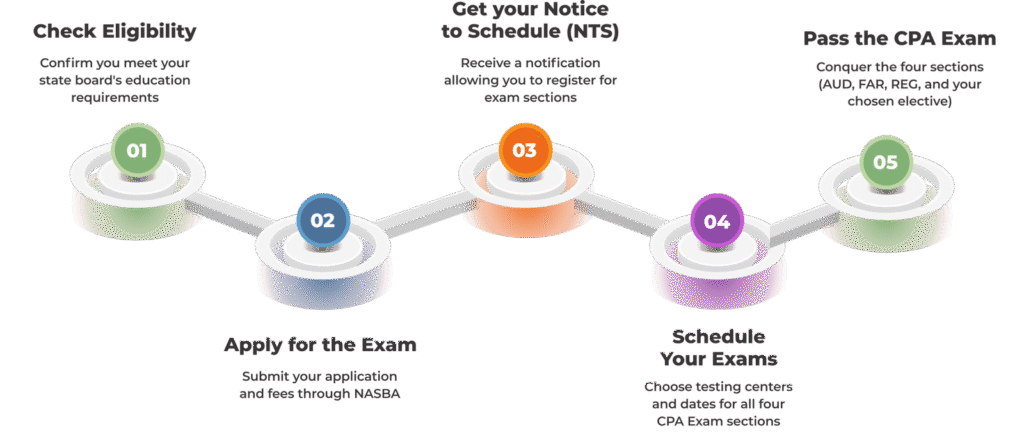

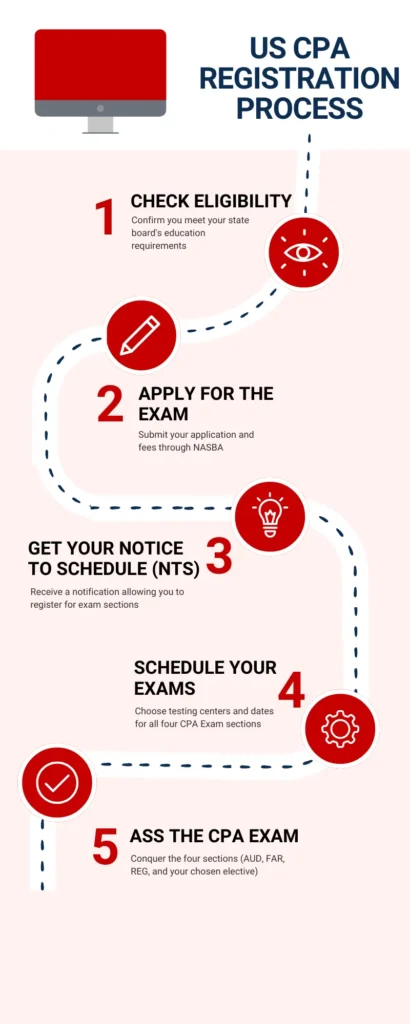

US CPA Registration Process

Eligibility

Apply

Get NTS

Schedule

Pass Exam

Check Eligibility

Confirm you meet your state board's education requirements

Advantages of UWorld US CPA

Exam-Focused Content

Practice questions mirror actual CPA & CMA exams, so there are no surprises on exam day.

Award-Winning Explanations

Illustrations and detailed solutions improve comprehension, memory, and retention.

Engaging Learning Tools

Video lectures, flashcards, and quizzes simplify complex concepts effectively.

Industry-Leading Instructors

Experienced US-accredited faculty provide practical insights and proven expertise.

Real Exam Experience

Mock tests and Prometric-like practice ensure confidence on test day.

Practice in Prometric Interface

Challenging questions prepare learners for the real exam environment.

Smart Learning Technology

Study planners, metrics, and SmartPath™ keep you focused and exam-ready.

Flexible Learning

Custom planners, flashcards, and tools adapt flexibly to your learning needs.

With UWorld, you don’t just study; you master concepts, retain them longer, and walk into your exam fully prepared.

UWorld CPA Review

UWorld has been a leader in high-stakes exam prep for over two decades, helping doctors, lawyers, accountants, and more obtain their desired certifications. UWorld CPA Review, formerly Roger and Wiley CPA Review, applies our proven learning methodologies to guide CPA candidates to licensure.

Our Achievements

- Helping over 4 million students prepare for high-stakes exams

- Proven results with a 90% Pass Rate on the CPA exam

- Pass in 3 months with SmartPath Technology™

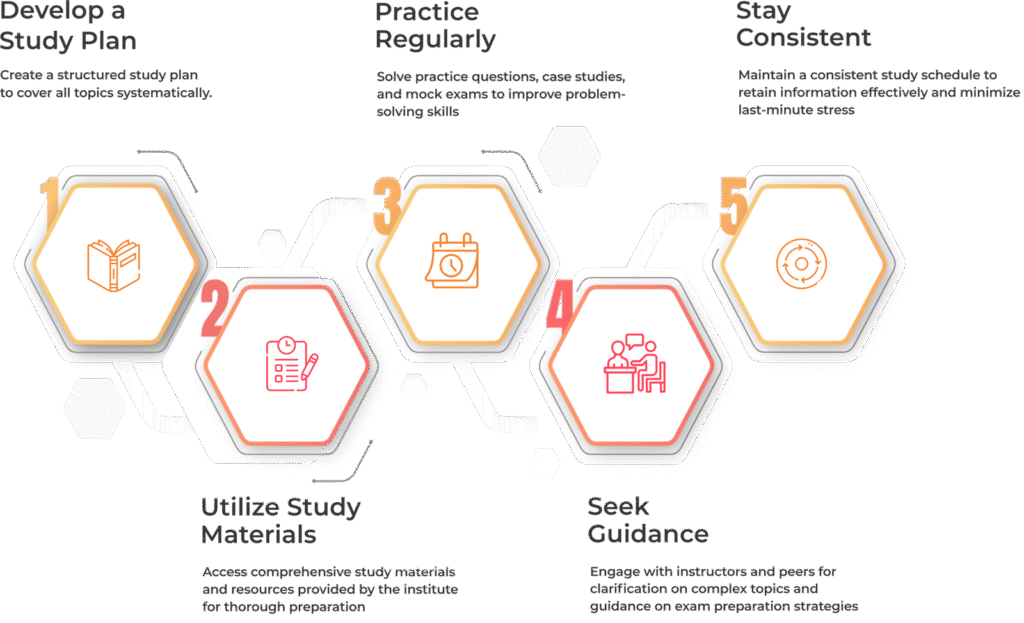

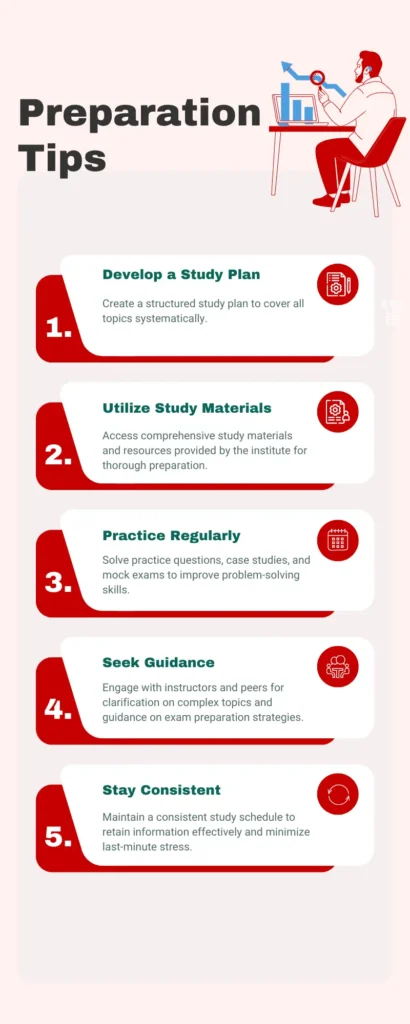

US CMA Exam Preparation Tips

US CPA Frequently Asked Questions (FAQs)

The US CPA (Certified Public Accountant) is a globally recognized credential awarded by the AICPA. It signifies expertise in accounting, auditing, taxation, and financial management.

The CPA exam has 4 papers: 3 core exams (AUD, FAR, REG) and 1 discipline exam (choose from BAR, ISC, or TCP).

You generally need a bachelor’s degree in commerce, accounting, or finance. Credit hours matter: 120 credits are required to take the exams, and 150 credits for licensure.

Yes. India is an approved exam location, so you can appear for the CPA exam without traveling abroad.

You can get a free eligibility check with us to understand your credit requirements and licensing options.

The CPA (Certified Public Accountant) certification is a professional credential granted by the AICPA to candidates who fulfill complete educational, work experience, and examination requirements. CPA training, like the one offered by Orbit Institutes in partnership with the UWorld CPA review course, provides comprehensive online classes designed to prepare candidates for the CPA exam. The course equips candidates with the knowledge and skills necessary to pass the CPA exam and obtain the CPA credential through expert instruction, comprehensive study materials, and structured guidance.

While both CPA and CA are prestigious accounting designations, they differ in their geographic recognition and examination structures.

US Certified Public Accountant (CPA):

- Globally recognized, offering international career opportunities.

- It is administered by the American Institute of Certified Public Accountants (AICPA).

- Can be completed in between 12-18 months.

- The exam structure includes four parts: 3 core sections: AUD, FAR, REG, and 1 discipline out of 3: BAR, ISC, and TCP.

- The pass rate of CPA is around 45-50% globally.

Indian Chartered Accountant (CA):

- Recognized in India.

- It is administered by the Institute of Chartered Accountants of India (ICAI).

- It typically takes about three to five years to complete, including practical training.

- The exam structure includes multiple levels covering accounting principles, taxation, auditing, and business laws.

- The pass rate of CA is between 5-7%.

In summary, while both certifications offer prestigious career paths in accounting, the US CPA designation is known for its global recognition and faster completion time. In contrast, the Indian CA provides a comprehensive accounting education and is recognized in India and various other countries.

The duration required to complete the CPA course may vary based on individual study patterns, prior knowledge, and the chosen study schedule. Typically, candidates may complete the course in between 12 to 18 months, depending on their availability and commitment to studying.

To pursue a CPA course in India, having an accounting background is essential. If a candidate falls short of the required credits, Orbit Institutes offers guidance on the necessary bridge courses to meet the eligibility criteria. Our expert advisors will assist you in identifying the most suitable path to fulfill the educational requirements for the CPA exam.

Completing the CPA certification does not automatically grant eligibility to work in the US. To work in the US, you’ll need authorization through a visa sponsorship from a US employer. A common visa for accounting jobs is the H-1B visa. Having a CPA can make you a strong candidate for employers seeking skilled professionals, increasing your chances of getting an H-1B sponsorship.

The US CPA course fee in India varies based on the institute, course offerings, and study materials provided. At Orbit Institutes, we understand the importance of financial flexibility. That’s why we offer interest-free installment plans for our CPA course, allowing you to pursue your professional goals without worrying about upfront payments. With our convenient payment options, you can focus on your studies and advance your career with ease.

Yes, Orbit Institutes understands the diverse needs of students, including working professionals. We provide flexible study schedules, including weekend classes, evening sessions, and online live interactive classes. Additionally, we offer 24/7 support, 100% placement assistance, mock tests and revision sessions, and mentorship by expert faculty. Our comprehensive approach has resulted in an 85%+ passing rate on our first CPA course attempt.

You need 120 credits to sit for the CPA exam and 150 credits to obtain your CPA license.

No, work experience is not required to take the CPA exam, but it is required to get your CPA license.

The CPA exam can be taken at Prometric centers in Ahmedabad, Bangalore, Chennai, Delhi, Hyderabad, Kolkata, Mumbai, and Trivandrum.